Key messages that emerged from the working tables with mobility stakeholders

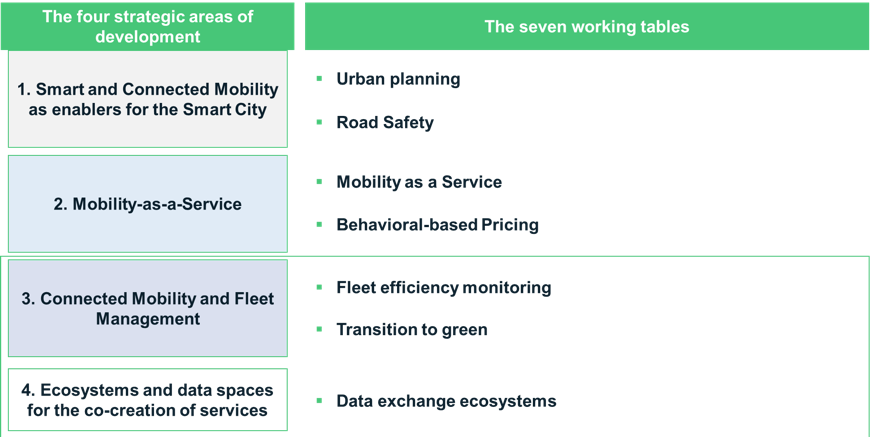

This article describes the key messages that emerged during the round tables organised by OCTO and The European House – Ambrosetti with leading companies and institutions in Italy in the implementation of connected mobility projects. In particular, the working tables analysed in this article focused on the topics of the third strategic area of development, namely “Connected Mobility and Fleet Management ” and “Transition to Green”.

OCTO and The European House – Ambrosetti organised, for the second consecutive year, an intense stakeholder engagement activity – involving more than 40 actors – with the aim of understanding the real needs of mobility actors and promoting a synergic development of a new paradigm of connected, sustainable and smart mobility.

Figure 1 The four strategic development areas and the seven working tables

Fleet Monitoring

The working table on fleet efficiency monitoring was designed with the aim of identifying opportunities for the development of new solutions that could not only enable efficiency and cost-effectiveness benefits for fleet managers, but also foster the definition of operating models closer to customer needs and sustainability goals.

Specifically, the analyses considered different types of fleets: from short-term rental fleets to long-term rental, from corporate car sharing to micro-mobility vehicle sharing.

Some key trends emerged from the analyses. For example, overall, over the past three years, probably also due to the pandemic shock, short-term rental fleets have recorded a 28% reduction in the number of vehicles. This reduction has not been the same across the different types of vehicle fleets: in fact, while there has been a more marked reduction in passenger cars (-17%), there has been an increase in vans available for hire (+8%).

As far as long-term rental is concerned, there has been an increase in the available fleet, +8% in the period 2019-2020. Furthermore, the turnover of long-term rental companies increased by +12% in the last year, from € 7.9 billion to around € 8.8 billion.

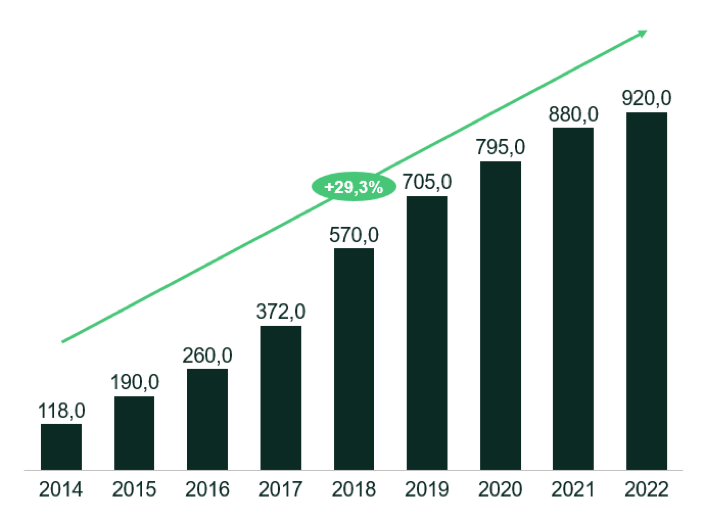

The corporate fleet market is at the forefront of technological evolution, being an area where the change in the concept of mobility is being tested. Consider that, to date, out of a total of 983,000 vehicles, there are already over 920,000 long-term rental vehicles on which telematics devices have been installed, representing an average growth of +29.3% over the last 8 years.

Figure 2 Telematics devices installed on long-term rental fleets (value in thousands and CAGR), 2014 – 2022. Source: elaboration The European House – Ambrosetti on Aniasa data, 2022

The growing spread of digital telematics systems makes it possible to complement the traditional mobility offer with new value-added services capable of ensuring:

- optimisation of operating costs;

- advantages in terms of increased security;

- mitigation of fraud risk;

- better organisation;

- lower environmental impact.

Another area analysed during the round tables is Corporate Car Sharing, a market with more than 4,000 units in 2021 (+8.9% vs. 2019). Corporate Car Sharing is composed of passenger cars 94% of the time and commercial vehicles the remaining part (6%). 61% of Corporate Car Sharing fleets are made-up of alternative fuel vehicles, i.e. Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Full Electric, a figure that highlights the driving role of Corporate Car Sharing in the market penetration of new sustainable engines.

Sharing, finally, shows different trends: car sharing vehicles have decreased by -22.4% over the last three years, while micro-mobility vehicles have increased by +8.9%. In micro-mobility sharing, the number of scooters increased by 360% over the last year (2020 vs. 2019). In contrast, the number of bicycles available fell from about 65,000 to just under 41,000, a reduction of 37%. In the car-sharing sector, there is also a change in terms of usage pattern: while the number of rentals decreased by 9%, the number of customers increased by 13% and the number of kilometres travelled increased by 9% (2021 vs. 2020), which denotes a gradual expansion of the business model outside urban centres and the ability to meet the needs of a growing user base.

The data revealed a varied landscape for fleet managers, a landscape for which several key messages were identified that highlight the need for business efficiency and innovation:

- The adoption and deployment of telematics solutions in fleets is an important step towards improving management operations and making them more efficient;

- Increasingly, the boundary between different mobility offers will disappear and they will have to be integrated to provide new services to users. Fleet managers will have to use data to dynamically identify customer needs and make operating models more flexible;

- Performance with regard to consumption, emissions and overall fleet management must be closely monitored in order to set concrete, measurable and communicable sustainability strategies;

- Data will drive the energy transition to new drives, and the integration of data with blockchain technology will enable a breakthrough in demonstration and liability management processes.

Transition to Green

The penultimate working table was dedicated to the topic of Transition to green, a particularly challenging area also considering the resources made available by the PNRR. The working table aimed to engage mobility stakeholders and utilities to identify opportunities for value creation in the transition to new paradigms of sustainable mobility in line with OCTO’s Vision Zero (zero accidents, zero congestion, zero pollution).

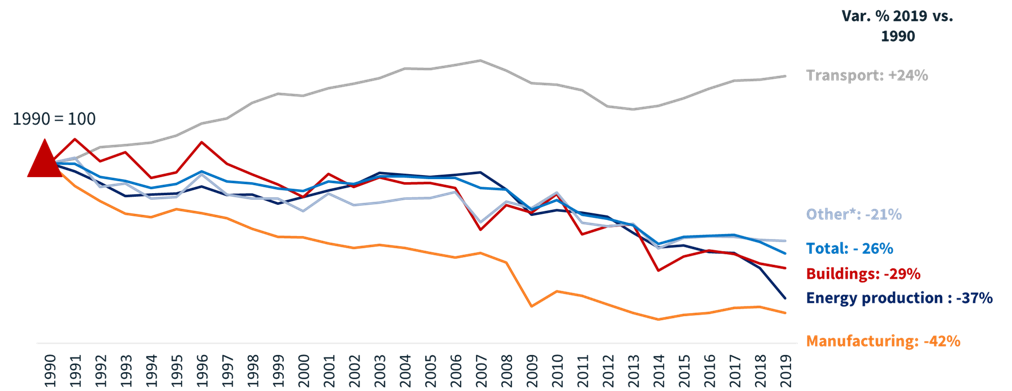

The green trend is particularly important for the transport sector. At European level, the sector is the only one to show an increasing trend in emissions since 1990 (+24%) – in contrast to the average emissions, which have fallen by 26% over the same period.

Figure 3 Evolution of GHG emissions by source sector in Europe (%, 1990=100), 1990-2019. Source: The European House – Ambrosetti elaboration on Eurostat data, 2022

It is important for mobility stakeholders to prepare for the green transition. While on the one hand, 80% of citizens are ready to choose a green vehicle (in particular in 46% of cases the choice is driven by the intention to be sustainable), on the other hand, in 92% of cases, consumers still consider the barrier due to the so-called range anxiety concerning the possibility of recharging and vehicle autonomy to be high.

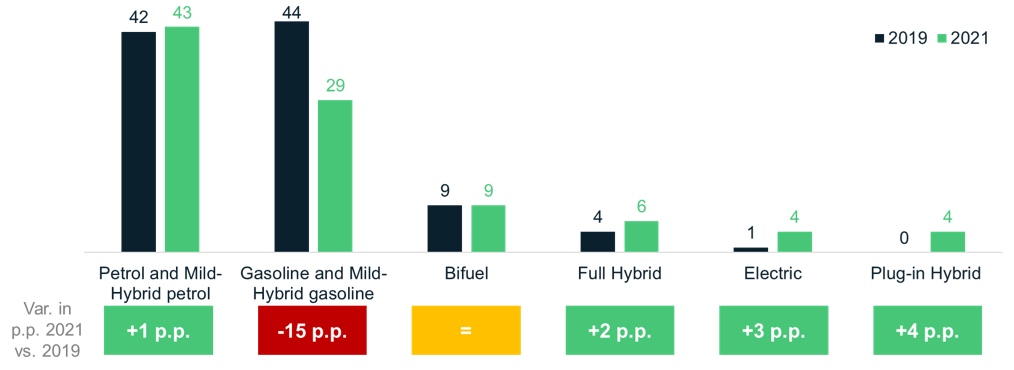

A clear trend is related to the acceleration of the spread of electric vehicles – necessarily to be read in connection with the presence of specific incentives. In fact, compared to November 2019, registrations of electric vehicles in Italy have increased 2.3 times.

Figure 4 New registrations in the Italian market by motorisation (percentage value), 2019 and 2021. Source: elaboration The European House – Ambrosetti on Dataforce data, 2022

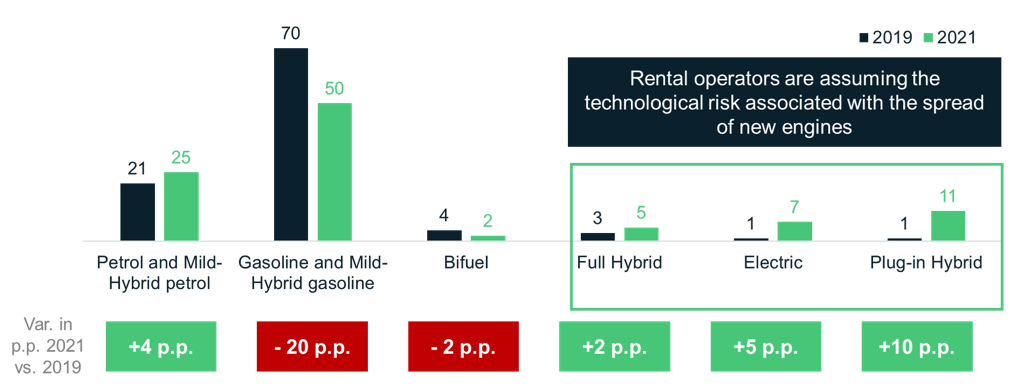

Comparing the growth trends in registrations of green engines on the market and in the long-term rental sector, the latter is favouring a greater spread of hybrid and electric engines, respectively electric (+5 p.p. vs. +3 p.p. in 2019-2021) and plug-in hybrid (+10 p.p. vs. +4 p.p. in the last two years). It is therefore clear that rental operators are assuming the technological risk associated with the spread of new powertrains.

This transition will not only impact fleet managers’ ability to assess the residual value of the vehicle, but also, and above all, the definition of new operating models that will necessarily have to be based on different service chains. To get a measure of these impacts, one need only consider that 54% of the industrial cost of an electric vehicle is linked to components not found in a conventional vehicle.

Figure 5 Vehicles in long-term rental by fuel in Italy (percentage value), 2019 and 2021. Source: elaboration The European House – Ambrosetti on Dataforce data, 2022

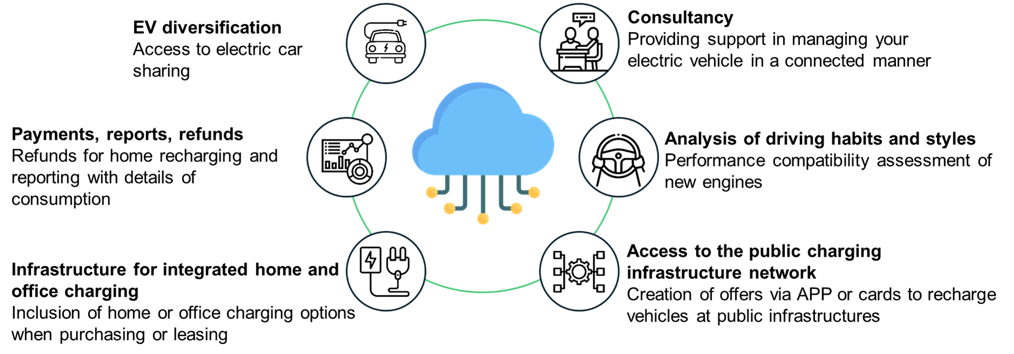

Finally, the increased use of alternative fuel vehicles in long-term rental will have to be fostered by an offer model increasingly based on complete service packages able to cover all customer needs – these packages are made possible by the creation of stakeholder ecosystems and the use of data and digital technologies to better manage and understand customer needs.

Figure 6 The evolutionary elements of the Long-Term Rental service model. Source: elaboration The European House – Ambrosetti on data from ALD Automotive, 2022

A number of key messages emerged from the ‘Transition to green’ working group that can guide the development of the mobility sector in the near future:

- The data make it possible to monitor the state of urban mobility and optimise the planning of interventions to reduce environmental impacts;

- The data make it possible to analyse the needs of each actor in order to choose the best solution based on the specific context;

- The penetration of new motorisation must be accompanied by a model change that combines service provision with vehicle equipment;

- Rental operators are taking on the technological risk. The ability to acquire and manage data from the vehicle is crucial to reduce risks and better manage the transition to new technologies and engines;

- New models such as Corporate Car Sharing make it possible to make shared services available to a wider audience (customer base) and accompany the transition to new motorisation.

Author:

The European House – Ambrosetti