Solutions for Incident and Claims Management

Innovative solutions that transform claims management, reducing claims time and limiting fraud through the use of advanced technologies.

Crash Reconstruction

Reducing compensation times, optimising the entire settlement process, limiting insurance fraud: the OCTO ability to identify, reconstruct and validate a crash is a turning point in the traditional management of claims.

This capacity, based on the interaction between devices installed on board vehicles and the OCTO platform, is turned into speed over providing detailed information on the event context and dynamics, helping the company understand the dynamics, in the correct attribution of responsibility, in assessing damages and reducing fraud.

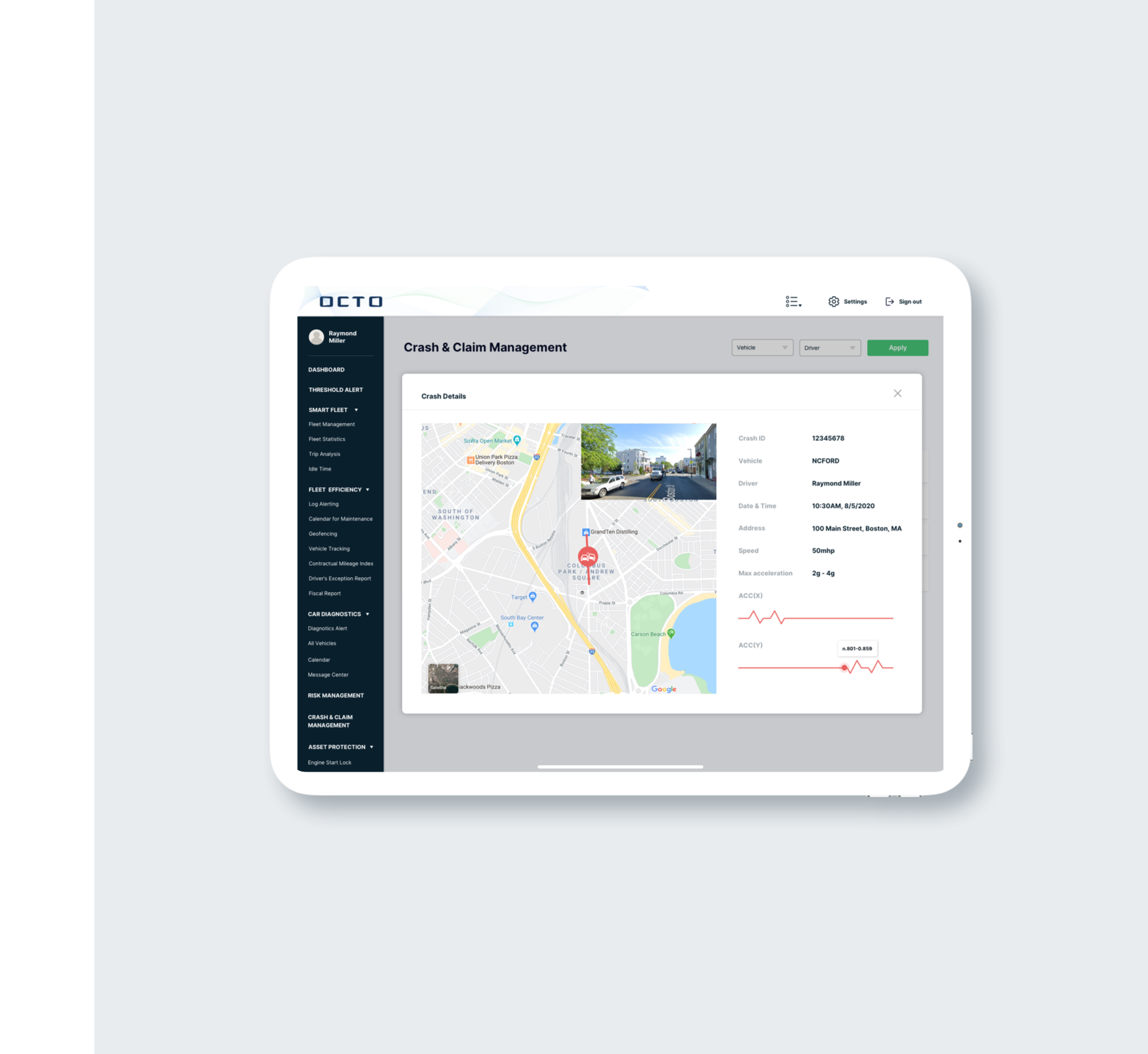

Crash Report

Sums up the most important information on the accident that enables the insurer to integrate any information collected by the insured with objective data taken from the device on board. These data include: accident date and time, geo-location, speed of impact with indication of direction and intensity and the interactive map showing vehicle position and route. Then the OCTO claim management Dashboard 2D enables a detailed reconstruction of an accident, allowing experts to view the event. Thanks to a “virtual witness”, the insurance company can reliably assign responsibility and settle the claim, limiting any potential fraud.

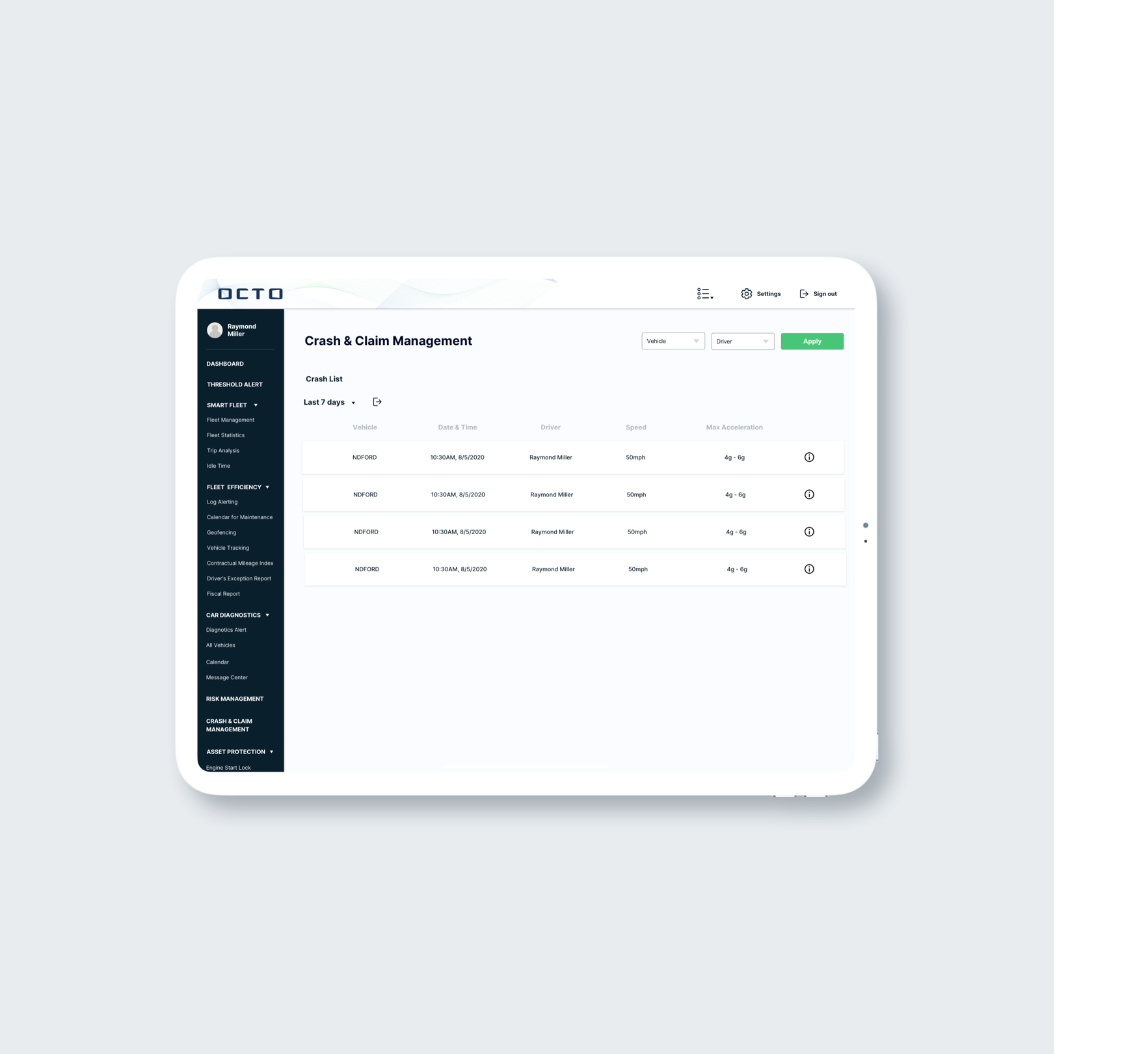

Claims Management Dashboard

Provides access to the sophisticated, advanced reconstruction of the crash and can provide a powerful, more understandable view of impact dynamics. Thanks to a dynamic reconstruction motor, the accident can be reconstructed virtually with a video showing the vehicle moving before, during and after impact.

Damage Preview

Based on Artificial Intelligence, this solution enriches the Crash Report with data enabling an accurate estimate of damage to the vehicle following impact.

There are multiple solution benefits: reduction in average claim management times, better assessment of compensation costs, containing insurance frauds.

This solution enables:

– calculation of vehicle damage, ascertaining which vehicle parts are affected by the blow and damaged;

– detailed identification of vehicle parts to be replaced or repaired;

– definition of an accurate estimate of the total repair cost.

Video Damage Evaluation

Video Damage Evaluation is OCTO’s solution capable of providing an accurate estimate of the damage sustained by the vehicle as a result of an accident through a simple video shot autonomously by the insured with their smartphone.

The use of Artificial Intelligence, through machine learning algorithms, makes it possible to detect and assess the damage sustained in just a few minutes, streamlining claims handling times.

Benefits of the solution:

– Speed up claims processing, from accident detection to settlement

– Simplify the settlement process for small claims by eliminating the intervention of an insurance adjuster.

– Reduce fraudulent claims

– No need to install an APP: simply click on a link sent by SMS.

Early FNOL

The crash detection through OCTO systems enables services for the benefit not only of the insurance company but also of the driver himself. Thanks to Early FNOL it is in fact possible to reduce opening times, management and settlement of the accident, but also to activate timely assistance to the driver (if necessary) for his safety.

The Insurance Company

Automatically receives the “First Notification of Loss (or First Notification of Loss)” with restriction of the time frame between the occurrence of the event and its registration in the systems. This makes it possible to reduce the handling time of the claim, accelerate the timing and accuracy of the settlement, contain fraud.

The driver

Is promptly contacted once the accident has been detected, both to receive immediate support in managing the situation and to collect useful information related to the accident.

Claim Verification

A tool that, in “pull-mode”, gives insurance companies the opportunity to acquire data on claims with no associated accidents and therefore requiring verification to prevent possible fraud. For each accident OCTO can provide a report containing the crash data and other travel information, including the GPS position of the vehicle, at the declared event time.

Forensic Dossier

Thanks to technology and its experience in the sector, OCTO can produce objective, reliable proof to be used in court to counter possible fraud and reduce time needed to settle disputes. Provides the insurance company with legal and forensic support by producing official documents, experts and consultancy if there should be claim disputes.

Training for telematics Claim

To maximise the benefits deriving from the adoption of telematics in Crash & Claims processes, OCTO provides all stakeholders involved in the process with a personalized training program according to the professional role covered. The tools supporting the OCTO solutions are simple and intuitive, but proper operator training can allow you to get the most out of the system.

It is addressed to:

· Insurance adjusters

· FNOL operators

· Liquidators

· Fraud investigators

· Dynamic Crash investigators

· Lawyers

Crash Detection via Smartphone

Crash Detection via Smartphone is the new solution capable of detecting medium and severe crashes* using the on-board sensors in smartphones. The smartphone-based plug-in is available as SDK for a seamless integration into the customer application or embedded in OCTO Digital Driver™ solution.

Accident detection only works while the vehicle is moving and is available anywhere in the vehicle. Drivers receive details of the accident via the app.

5 benefits for Company and Driver:

1) Device not required

2) Few seconds to install the App

3) 80% matching rate

4) Optimises the claims process thanks to telematics data

5) It helps to provide immediate assistance to the driver in the event of a crash

*The algorithm is able to identify medium and severe accidents even at speeds as low as about 16kph/10mph, although it considers many other parameters such as acceleration, lateral displacement and other vehicle dynamics”

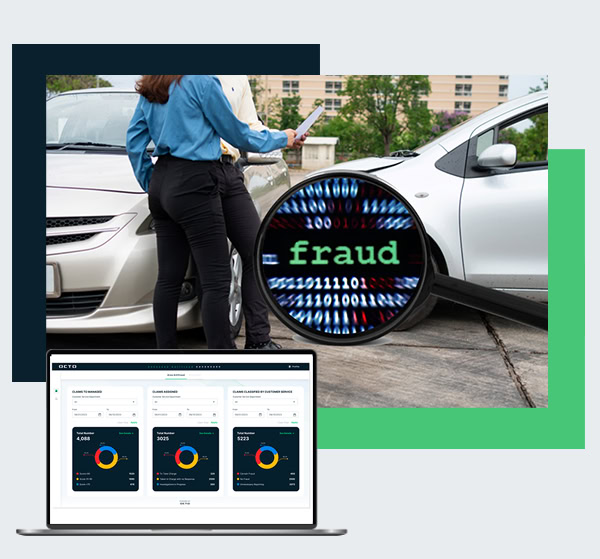

Fraud Shield

Identifying fraud to reduce the cost of claims and for better claims management is vital for improving the loss ratio.

Fraud Shield is a dashboard based on Machine Learning technology that supports claims adjusters in detecting suspected acts of fraud. Using telematics data, it automatically detects inconsistencies in the claim’s statement by assessing multiple parameters such as the date, time, vehicle location, accident record and sustained damages. The results are then provided as a easy to review fraud probability index.

Request a Demo

Tell us a bit about yourself, and we’ll tell you a lot more about our solutions.