Recently, the McKinsey Center for Future Mobility published a report on shared mobility. Researchers present a point of situation of the sector, reaching the conclusion that having weathered a pandemic, regulatory whiplash, and a host of other hurdles, shared mobility endures.

Here is where things stand today.

The shared-mobility market

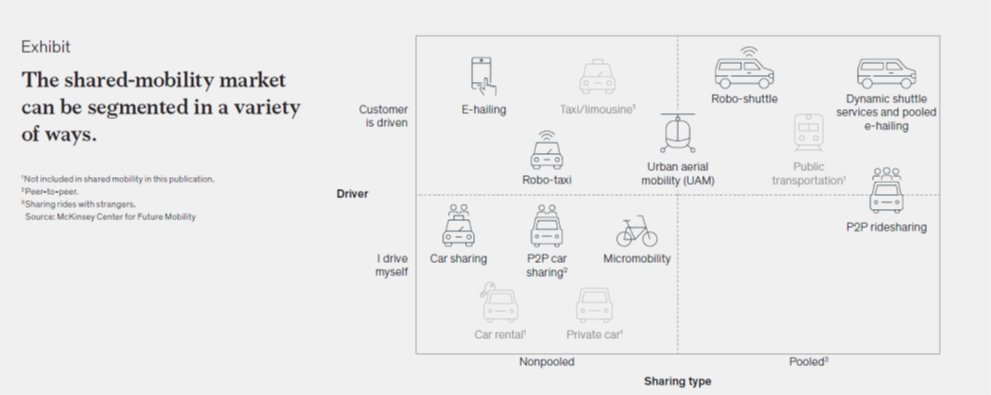

First of all, researchers, segmented the shared-mobility market along seven mobility verticals, depending on vehicle-ownership structure (private versus fleet vehicles), whether the customer is driving or being driven, and whether or not rides are shared with strangers (pooled or nonpooled). Additional layers of granularity can always be added, depending on the context (exhibit).

Market size

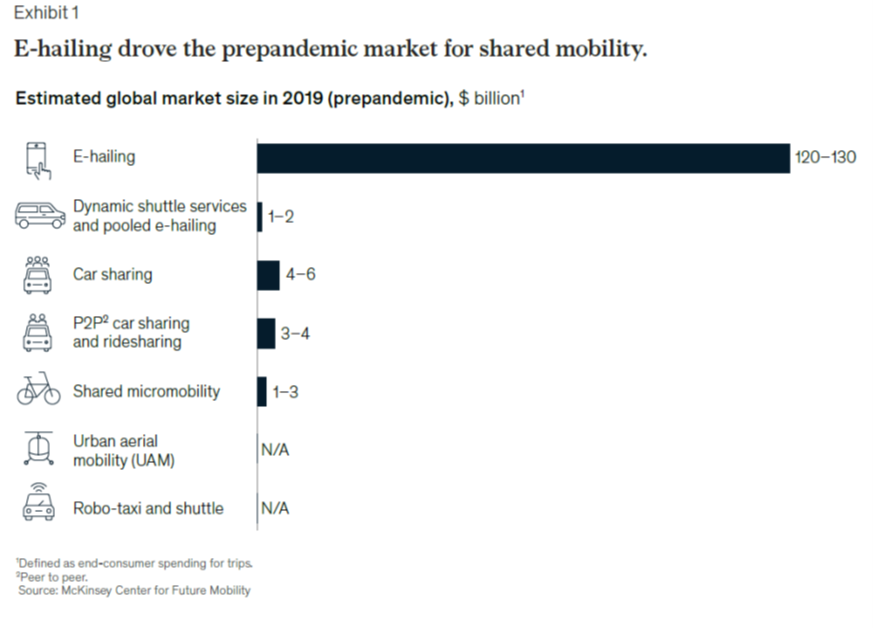

Next step is to answer to the question “how big the market is”. The shared-mobility market accounted for approximately $130 billion to $140 billion in global consumer spending in 2019 (Exhibit 1). Out of this, e-hailing accounted for the largest share, $120 billion to $130 billion, which is more than 90 percent of the total market. Taken together, car sharing and peer-to-peer car sharing account for less than 10 percent of this market, which reflects e-hailing’s higher convenience (that is, the customer is driven, can spend the time in the vehicle on other activities, and does not have to find a parking space).

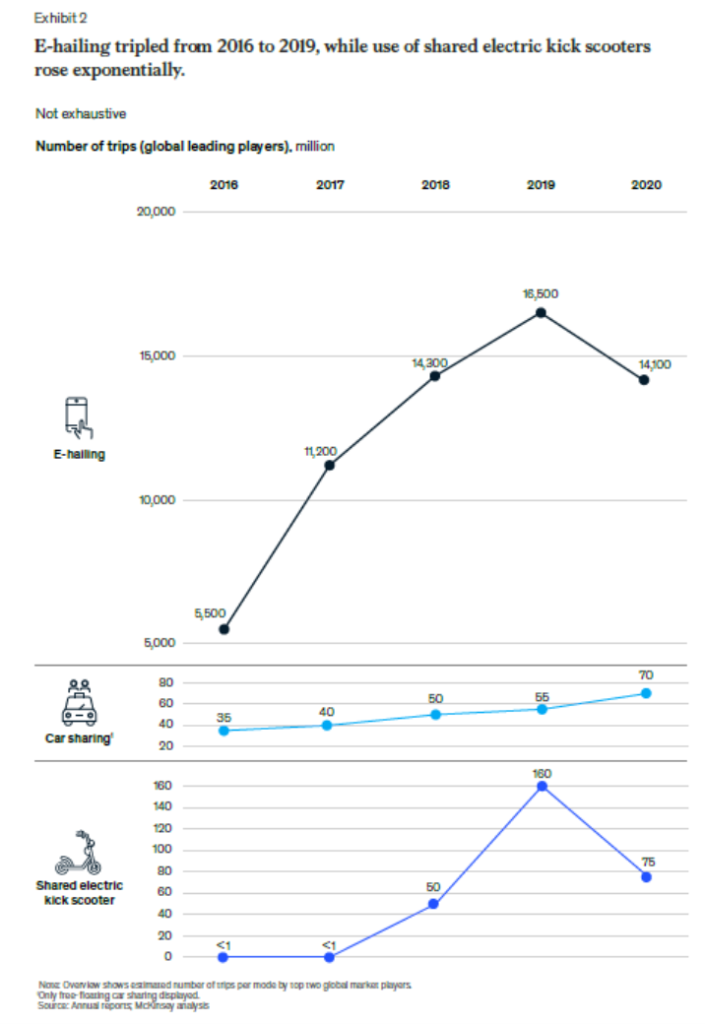

Looking at the evolution of trip development over time, Exhibit 2 shows that e-hailing retained a clearly dominant role in the shared-mobility market from 2016 to 2019, showing massive growth over those four years (amount of trips tripled). Shared micromobility shows an even stronger evolution— while electric-scooter sharing did not play a major role before 2017, it accelerated in 2018 and 2019 (from fewer than 1 million trips until 2017 to greater than 160 million trips in 2019, when looking at the largest players). According to the Mc Kinsey model, micromobility could reach a consumer-spending potential of $300 billion to $500 billion globally by 2030 (combining shared and private micromobility), thus becoming three to four times larger than today’s global e-hailing market. This amount could grow even higher as the pandemic winds down and normal activities resume.

Understanding the shared-mobility market today: Investments

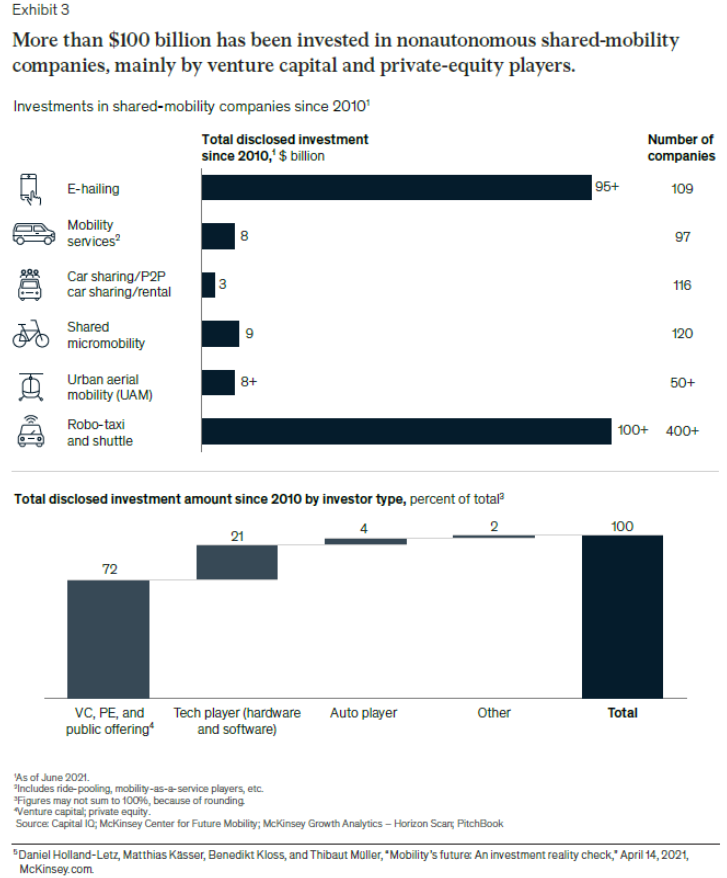

Regarding the quantity and type of investments, researchers highlighted that since 2010, more than $100 billion has been invested in shared-mobility companies (Exhibit 3). Looking deeper into types of investors, it’s not the automotive players that are investing in shared-mobility companies. Instead, around 72 percent of the total amount of disclosed investment since 2010 has come from venture capital and private-equity players, suggesting a bet on the future rather than on established and already sustainable business models.

Understanding the shared-mobility market today: Consumers

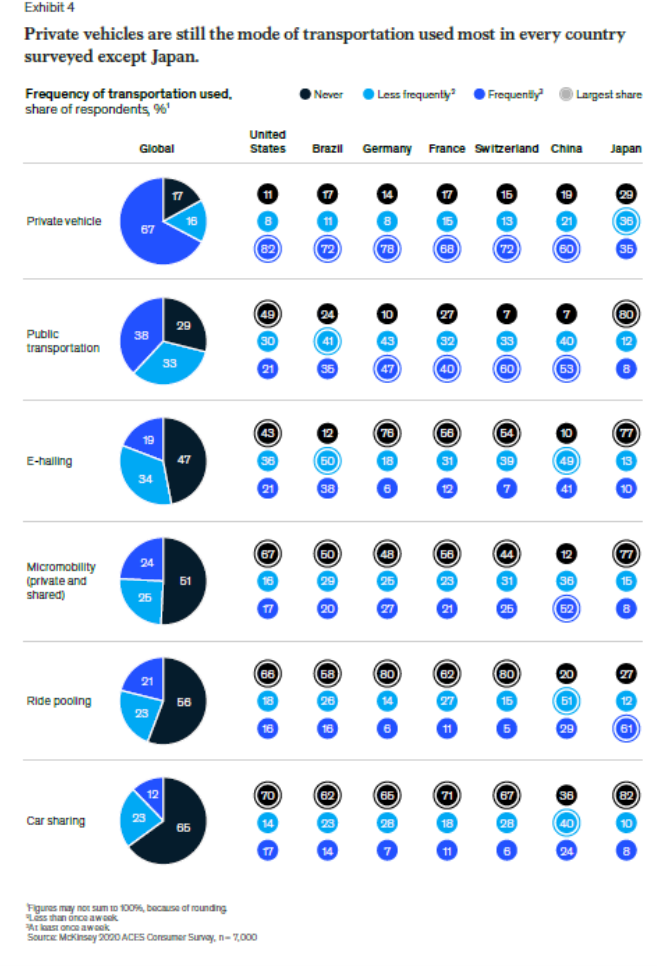

Regarding the consumers side, researchers pointed out that private vehicles remain the most popular mode of transport in almost every country (Exhibit 4). Globally, 67 percent of survey respondents said they use their private vehicles frequently (that is, at least once a week), whereas 38 percent said they used public transportation frequently. Car sharing is the least used mode on average by consumers today, which reflects the lower trip numbers. E-hailing is the most popular for consumers in Brazil, China, and the United States—in China, 90 percent of consumers stated that they use e-hailing services at least once per week.

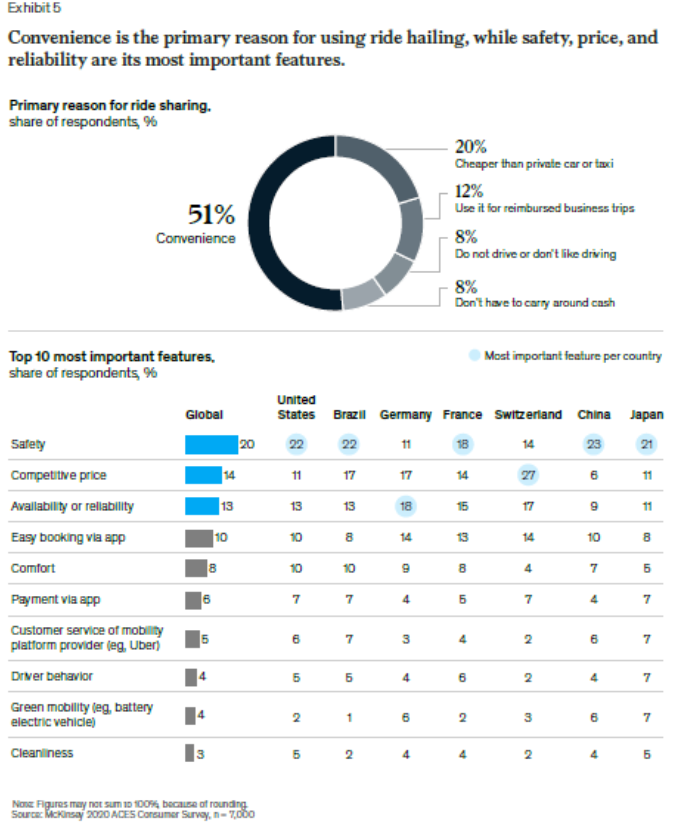

Survey respondents said that their main reason for using shared mobility is convenience (Exhibit 5). This reflects today’s dominance of e-hailing over other shared-mobility modes. The most important features of shared-mobility services for consumers are safety, a competitive price, and availability. The latter, especially, might be an important factor in shared mobility’s ability to replace private-car ownership in the long term. Notably, availability is the most important feature for German consumers.

Future mobility modes

Regarding future mobility modes, researchers concluded that when new mobility modes do arise (for example, robo-taxis or flying taxis), they expect the market potential of other modes to decrease and shift or at least remain stable through 2030. This will depend on regulatory developments (for example, cities deincentivizing or restricting private-car ownership), technology developments (for example, autonomous-driving readiness), and consumer adoption.

PS: the full report can be downloaded here: