Authors Kersten Heineke, Ruth Heuss, Philipp Kampshoff, Ani Kelkar, and Martin Kellner, from McKinsey, published an article titled “The road to affordable autonomous mobility”. The article provides an up- to-date review on this issue. Here are some of the key issues.

The researchers point out that the adoption of robo-taxis and robo-shuttles depends on four main drivers: regulations, technology readiness, business-case attractiveness, and customer preference.

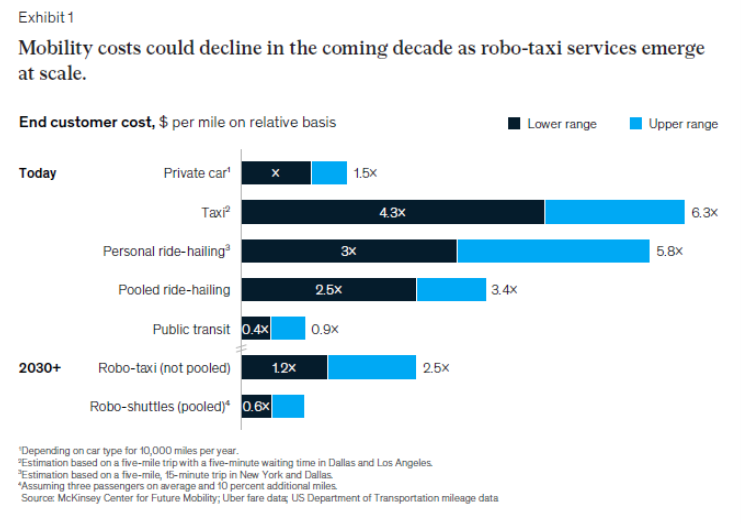

Customer preference strongly depends on how the cost of these AV services compares with other mobility modes. While fully burdened costs for such services are very high today—because of the high cost of technology, development, and operations—they could decline significantly in the coming decade as AV technology advances and smarter, more seamless, multimodal mobility ecosystems emerge.

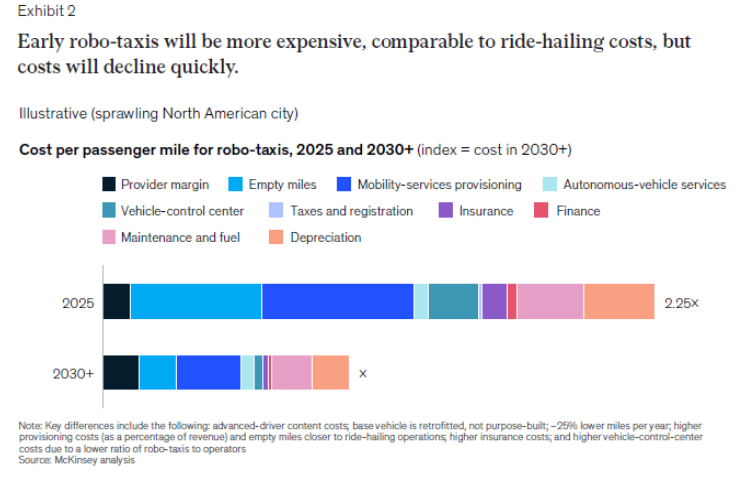

The study stresses that this disruption isn’t here yet—early robo-taxis will cost more (fully burdened) than today’s driver-based ride-hailing services—but it expects the difference between the two to disappear quickly. Their analysis shows that the cost per mile for a robo taxi could drop by more than 50 percent between 2025 and 2030. The major drivers of this reduction include lower hardware costs due to declining costs of high-performance chips, operational improvements (such as lower maintenance needs and higher overall mileage), lower costs of mobility services provisioning due to scale, a decrease in empty miles traveled, and greater economies of scale, which distribute development and validation costs across more vehicles.

On the other hand, the investigation indicates that robo-taxis are expected to have much higher operating costs than private cars. Especially in the first years after the technology’s introduction, according to the study, AV systems will experience significant maintenance costs based on the need for regular checkups, time-intensive error tracking, and sensor service and calibration.

In addition to price, greater convenience could drive consumer acceptance of robi-taxis, along with the perception of safety if AV performance continues to improve.

Finally, cities will take different strategic approaches to robo-taxis depending on their needs. For example, cities looking to protect public transport or traditional taxis from lower-cost robo-taxis or robo shuttles might introduce restrictive licensing plans. Others could subsidize pooled robo-shuttles as last mile solutions—to and from public-transit stations— to attract more public transit passengers or to avoid added investments in bus-transit networks. Paris is just one example of a city shaping its mobility mix. There, local governments have expressed support for biking and walking over car-based mobility.

Location, vehicle type, and scale will drive how much AV services cost

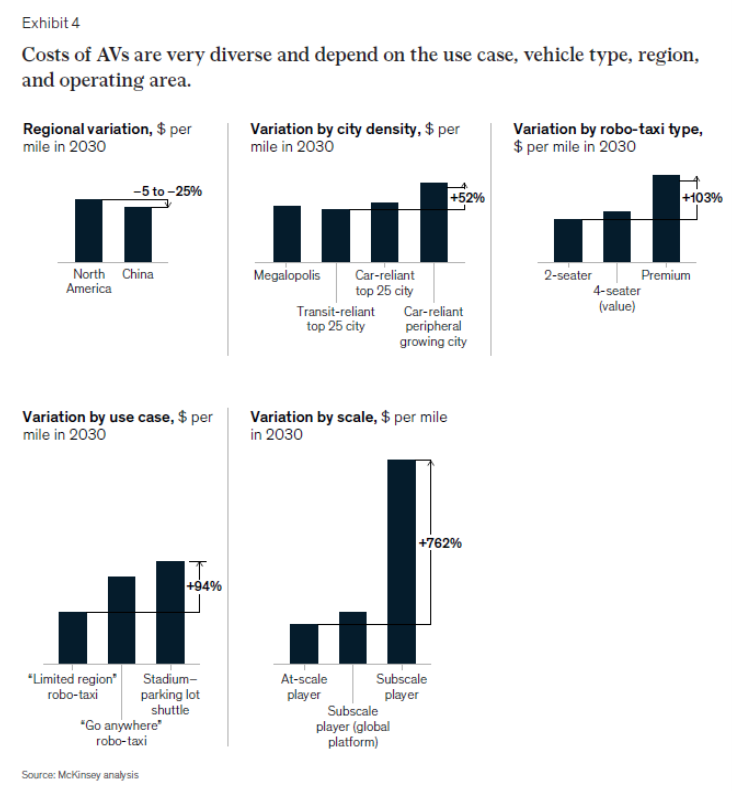

According to the study, a robo-taxi fleet’s area of operation has an impact on its overall cost. For example, a robo-taxi trip in China could be 5 to 25 percent cheaper than a trip of the same length in the United States. The differences would result from lower labor and energy costs as well as lower base-vehicle costs resulting from different customer requirements. Despite this difference, buying-power variation across geographies might still make for a strong business case in support of AVs.

City density will also play a significant role in the per-mile costs of shared AV services. For areas with lower population density, robo-taxis will have a higher share of empty miles (miles driven without generating revenue; that is, with no occupant), requiring fleets to charge more for loaded miles (miles driven with revenue generation; that is at least one occupant) to compensate.

The Operational scale also affects robo-taxi costs on a global level, given the high initial investment that fleets must amortize. Players at scale could likely achieve price points six to eight times lower than those of subscale rivals looking to build end-to-end operations that include assembling the technology stack and operating fleets of robo-taxis. The authors believe that players who initially focus on selected local markets will eventually have to partner with at-scale players and rely on local operational excellence to remain competitive.

Implications for industry stakeholders

The extended robo-taxi ecosystem includes a variety of players, from automakers and their traditional top-tier suppliers to leading technology players, mobility-services providers, cities, and transit agencies and regulators.

Automakers. OEMs that want to enter the robo taxi industry as vehicle providers need to develop purpose-built vehicles with best-in-class durability, low maintenance costs, and high uptime availability. Predictive maintenance, modular battery sizes, and fast-charging capabilities are the primary drivers for increased availability. The investigation indicates that if OEMs want to become robo-taxi players themselves, they need to prepare for major changes by becoming mobility-services providers and by seeking partners, investors, and AV technology providers to orchestrate a full-stack solution. Alternatively, an OEM could offer an integrated robo-taxi vehicle with in-house AV stack but find partners for the mobility-services offer.

Mobility-services providers. Given the industry’s intense focus on operational excellence, the study underlines that providers should concentrate on becoming market leaders in a few cities, not niche players in many, to capitalize on economies of scale in support of infrastructure such as vehicle-control centers or local robo-taxi hubs. Providers should put a high priority on reducing the costs of operations and mobility-services provisioning.

Cities and transit agencies. Municipalities can influence pricing via subsidies or license costs to steer their mobility mix. Cities could also lease conveniently situated properties to robo-taxi players to lower the costs for empty rides between robo-taxi hubs and serviced areas.

Suppliers. The research indicates that suppliers should understand where to allocate their R&D spending, especially regarding improvements in AV durability and energy demand. Some might consider changing their business models, shifting from parts vendors to AV-maintenance providers or vehicle-control center operators.

AV technology players. AV technology players need to critically define their role in the ecosystem and the level of partnerships they need. These players can work across the AV tech stack through mobility.

Role of autonomy in decarbonizing mobility

The researchers emphasize that the pace and nature of AV rollout have significant repercussions for the carbon footprint of the mobility sector. In an unconstrained rollout, AVs could increase vehicle miles traveled due to lower costs and higher convenience. This will act as a headwind to mobility decarbonization even though these services will likely use an electric powertrain. In a seamless mobility transition, however, these services will complement a more environmentally friendly mobility ecosystem and increase use of resources. This will create a tailwind to decarbonization efforts, especially if cities encourage pooling use of robo-taxis and shuttles or close synchronization with public transit.

COVID-19’s impact on autonomous driving

Based on substantial research, McKinsey expects few significant changes in consumer mobility behavior following the major disruptions caused by the COVID-19 crisis. However, walking, biking, micromobility, and car sharing might win a few customers away from public transit. Additional findings include the following:

- Short-term implications: Companies suspended AV testing during 2020 as both OEMs and their suppliers throttled back investments in this area. Some AV players announced layoffs or completely halted efforts.

- Midterm implications: Players are delaying AV development projects, typically by months, not years. Industry observers expect further industry consolidation and eventual increases in cooperation.

- Importance: General importance remains high. Companies still view robo-taxis as the largest AV revenue pool, with up to $1.3 trillion in revenues by 2030. Autonomous driving should continue to grow in importance from the customer’s point of view.

- Player landscape: While several OEMs and tier-one suppliers are reducing their investments, tech players continue to spend at a high pace and have secured additional investments. For instance, one tech player secured a $3 billion financing round, while another secured $500 million. Consequently, the gap between leading players and fast followers will grow, potentially leading to a market with fewer players.