Last 29 of November, the European Commission, DG CONNECT organized a workshop on the software to be used by the next generation of autonomous vehicles. Here are some of the key issues.

The next few years are critical for the European automotive industry to close the gap to leading new Original Equipment Manufacturers (OEMs) and tech players with regards to software and user experience to defend the leading position in the automotive industry. While OEMs and suppliers are at different levels in terms of skills, capabilities and time-to-market, several players have already started to transform themselves into more software-driven companies. The paper points out that the focus, so far, has been on individual efforts towards own technology platforms, impeding efficiencies across the industry when such investments replicate efforts on elements that are not visible to the customer and sources of competitiveness.

Customer preferences for vehicles and their features are changing – customers expect vehicles to behave like connected consumer devices. On the technology side, Electrical/Electronic (E/E) architecture is evolving toward domain-centralised and zone- or vehicle-centralised archetypes, which is reframing how systems and software functions should be built and integrated. Regarding software, the enablement of over-the-air updates – both from a regulatory requirement standpoint and as a means of satisfying consumer expectations – presents specific challenges related to version management and safety.

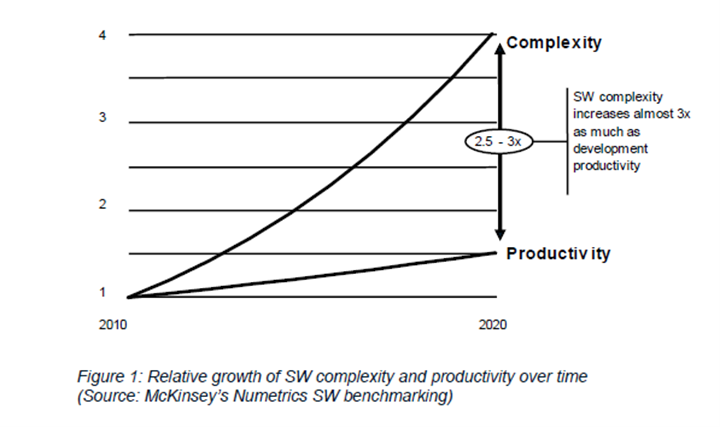

The complexity is further driven by lack of harmonised implementations across the industry, leading to high degree of redundant efforts to adjust towards different technologies and an overall loss of efficiency of the European Automotive Industry.

New headwinds are arising from new competitors, for example, new OEMs from other global regions focusing on battery electric vehicles, and tech players. Incumbent OEMs and tier-one suppliers are already (significantly) behind new OEMs, which have started with greenfield architecture.

The lead of new, often non-European OEMs, which are building up software capabilities, might even increase over the next few years if incumbent OEMs and tier-one suppliers are not successful in managing the transition and acting immediately.

New tech players, such as Google, have also entered the market with competitive offerings and the advantage for their customers to save on development costs. Today, the infotainment stack is already dominated by screen mirroring solutions from Apple and Google.

For autonomous driving, Waymo is consistently attracting more and more partners, while incumbent OEMs are reducing their development efforts associated with autonomous ridesharing vehicles. New OEMs, such as Tesla or Nio, benefit from new E/E architectures with a high degree of centralization and no legacy.

The research stresses that with fewer innovations in software and new business models, products of incumbent OEMs have lost competitiveness compared to new OEMs, which might ultimately lead to lower sales figures and lower margins.

According to the study, with the first setbacks in software development and delayed timelines arising, the openness to join forces is increasing. Currently, a rising number of partnerships between OEMs and suppliers/tech players can be seen, as development costs are too high to be covered by a single player alone. There is a growing realisation that joining forces would also help to use existing development resources more effectively to increase speed and master the complexity trap.

The paper concludes that the market is being reconfigured. New platforms are being developed with an approach borrowed from the tech sector that aims to disrupt the status quo in automotive, just as it did in other industries (e.g., smartphones). To remain leading players in the industry, OEMs need to transform and build up new capabilities. New digital and software productivity has become mission critical to create competitive products and increase shareholder value.

For OEMs, several challenges were mentioned:

- Losing competitiveness in several disruptive features versus new and Chinese OEMs, for example, advanced driver assistance systems, over-the-air updatability, and connected services

- High degree of effort required to fix current software problems, leaving players without enough capacity to start building next-generation software platforms

- High costs of developing software, mainly driven by the need to redevelop existing functionalities for other hardware, often OEM proprietary platforms due to low compatibility

- Unmet user demand of frequent software updates (similar to smartphones) due to high development costs and complexity

- High efforts and costs related to managing software complexity, backward compatibility, and software maintenance after SOP mainly driven by missing interfaces and standards, as well as poor portability

- High switching costs of each player from legacy systems to new (jointly developed) software platforms

- Tight R&D budgets due to required transformations (for example, the transformation to electric vehicles or fulfilling the EU7 emissions standards)

After acknowledging the challenges facing the industry, there is a shared view that it needs to strengthen standards and reduce complexity and variance in non-differentiating components of the technology stack, increase cross-industry collaboration, and reduce redundant and unrequired efforts.

Initial agreements have been reached on the common direction a joint European effort towards an automotive software platform focusing only an open reference architecture and on non-differentiating software elements can go:

- A joint effort should enable the standardization of data formats, interfaces, and touchpoints

- Open source, in particular for reference implementations, will play a crucial role in facilitating open industry standards that go beyond specifications to standards in implementation and have proven to be an incubator of ecosystems in other industries as well. Hence, open source needs to be an integral part of a joint European effort.

- The targets of such an effort need to: a) drive widespread adoption to significantly reduce complexity across the industry (which only can be achieved by such widespread adoption) and b) support the industry to significantly increase speed and thereby time-to-market by building on mature software components created in an open-source ecosystem.

- The development of a standardised non-differentiating software stack (middleware layer) must be accompanied by the creation of corresponding development and validation tools matching productivity gains in automotive ADAS, AD, infotainment, state of the art CI/CD tool chains in order to achieve the required sensing and control software.

- In addition to delivering technical standards, a joint effort needs to incubate a developer ecosystem (for example, through automotive software development conferences) to proliferate the shared standard, invite open-source contributions, and thereby accelerate innovation – this should also include the involvement and effort of universities and other research institutes to enhance skills building in Europe.

Key success factors for an open European software-defined vehicle initiative include:

- Buy-in on highest management level of a significant and representative number of OEMs and suppliers from across key European Member States

- Working closely with other relevant initiatives (e.g., Eclipse SDV WG, COVESA, etc.)

- Identifying a sustainable cooperation framework, for example mandating leading software providers or creating a new (joint) entity to maintain the emerging open SDV reference architecture, and to manage a repository of open-source reference code. .

- Developing your own reference source code and not only specifications and standards. – Early customer adoption and implementation on OEM vehicles projects.

- Global perspective, taking into account developments in other regions and aiming for international impact.

A European initiative on the vehicle of the future, addressing both software and hardware, should leverage and build upon the broad range of efforts in the European Union.